Coins from the 1960s sit in an unusual place on the price spectrum. They are not ancient. They are not scarce by default. Yet some examples from this decade sell for five figures, while most others trade for little more than metal value. Understanding that gap saves time, money, and false expectations.

The short answer is direct: most 1960s U.S. coins are affordable, but a narrow group of dates, grades, and errors can cost serious money. High mintages keep prices grounded, while silver content and certified varieties create the upside. Learn the basics of this decade, so you won’t spend hundreds of dollars on a simple 1967 quarter.

Why the 1960s Still Matter

This decade marks a structural shift in U.S. coinage. Silver exited circulation. Clad coins replaced precious metal. Mint technology accelerated. These changes shaped how coins from the era behave on the market today.

Key forces at work:

- End of 90% silver circulation in 1964

- Short transition to 40% silver halves from 1965 to 1970

- Massive production numbers limiting scarcity

- A handful of standout varieties and high-grade survivors

Collectors who approach the 1960s with precision find value. Those who expect rarity across the board usually do not.

Silver Coinage: Where Most Value Comes From

Silver drives the baseline pricing for the decade. It explains why millions of coins remain collectible even without numismatic rarity.

1964 is the cutoff year.

Any U.S. dime, quarter, or half dollar dated 1964 or earlier contains 90% silver.

Approximate silver content:

- Dime: 0.0723 troy ounces

- Quarter: 0.1808 troy ounces

- Kennedy half: 0.3617 troy ounces

Circulated examples trade close to melt value. As silver prices fluctuate, so does the floor price. In normal market conditions, 90% silver quarters often land in the $5–12 range, depending on spot price and demand, easy to monitor via the coin identifier app.

The Kennedy Half Dollar Effect

The 1964 Kennedy half dollar deserves separate attention. It combines history, silver content, and collector demand in one coin. High mintages keep circulated pieces affordable, but pristine examples break away sharply.

- MS-65 to MS-67 pieces trade above melt

- MS-68 examples have crossed $10,000+ at auction

- Proof strikes attract steady demand

The spread between average and elite condition defines much of the 1960s market.

1965–1970: Reduced Silver, Reduced Premiums

After 1964, silver did not disappear overnight. Kennedy halves from 1965 to 1970 contain 40% silver, about 0.1479 troy ounces each.

These coins typically show:

- Strong bullion correlation

- Limited upside in circulated grades

- Better premiums in mint-state rolls and sets

In MS condition, prices often sit between $15 and $50, reinforcing their role as entry-level silver rather than high-end collectibles.

The Quick Reveal So Far

For most coins from the 1960s:

- Circulated pieces rarely exceed $1–5 unless silver

- Silver coins track melt first, collector demand second

- True premiums begin with condition, proofs, or varieties

The real price jumps do not come from age alone. They come from precision. Don’t you hesitate to use a coin worth app for extra price checks.

The 1960s Coins That Actually Break the Price Ceiling

Once silver value is removed from the equation, only a small number of 1960s coins push into serious money. These are not random finds. They share clear traits: documented varieties, strong visual diagnostics, and third-party certification. This is where the decade becomes interesting for advanced collectors.

Lincoln Cents with Real Upside

Pennies dominate the high-value end of the 1960s market. Their prices are driven by rarity and demand, not metal.

1960 Proof Small Date

Two date styles exist for 1960 proofs. The Small Date appears far less often and commands consistent premiums.

- Typical range: $50–300 in PR-67

- Higher grades escalate quickly

- Always sold certified

1960-D D Over D, Small Date Over Large Date

This is one of the most important modern U.S. cent varieties. A Small Date was impressed over a Large Date, paired with a repunched Denver mint mark.

- Scarce across all grades

- Strong demand from variety specialists

- MS-65 RD examples reach $5,000

Total mintage does not matter here. The variety itself is rare.

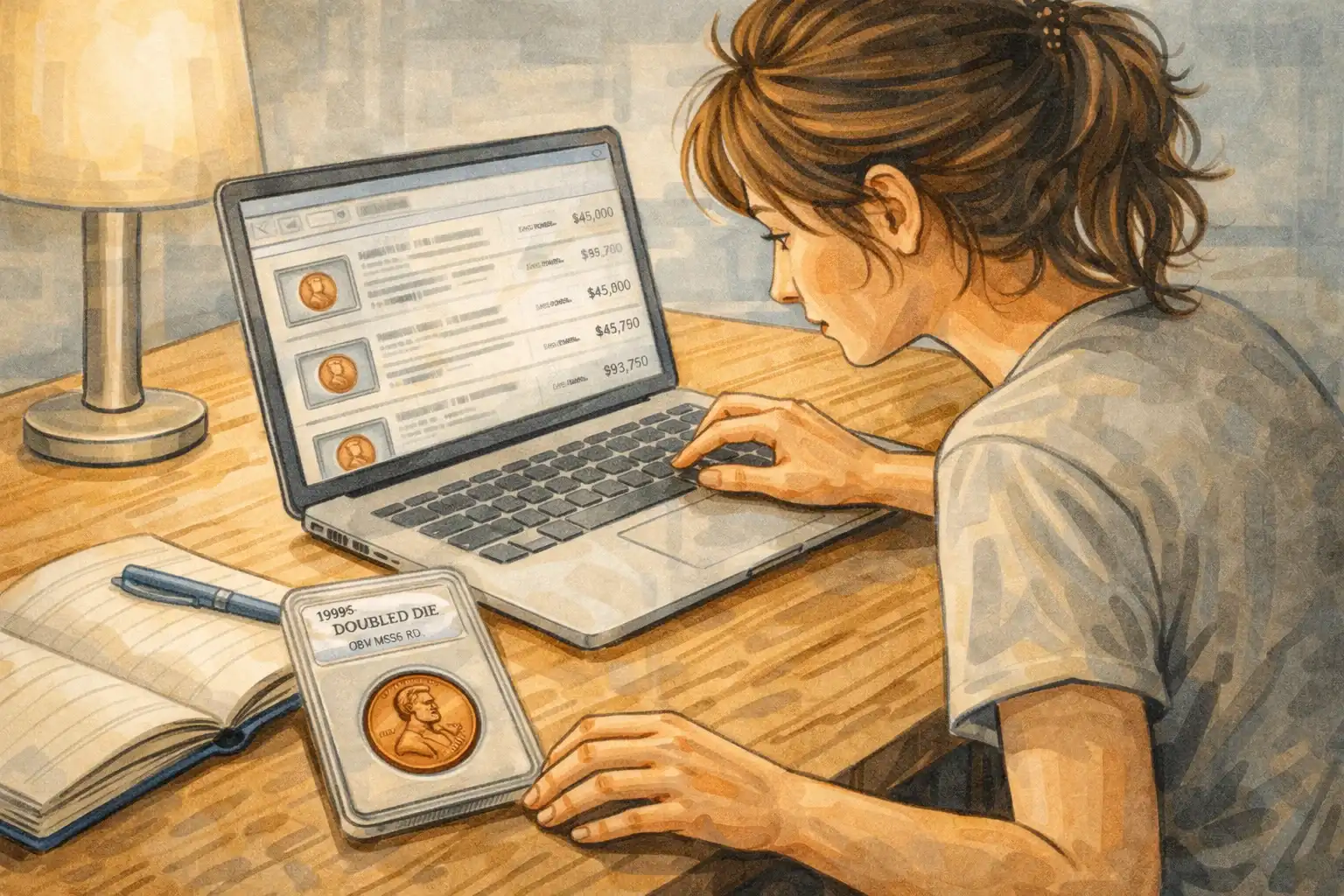

1969-S Doubled Die Obverse

The standout error of the decade. Bold hub doubling appears on “LIBERTY,” “IN GOD WE TRUST,” and the date.

- One of the most dramatic doubled dies ever struck

- Heavily counterfeited

- Certified examples have sold for $35,000+

Authentication is mandatory. Raw examples carry extreme risk.

1964-D Doubled Die Reverse

Less famous, but still valuable. Doubling shows on the reverse lettering.

- Commonly overlooked

- Prices range from $100 to $1,000, depending on grade

Silver Coins in Elite Condition

Silver coins from the 1960s rarely reach five figures unless condition becomes exceptional.

Examples include:

- 1964 Kennedy half dollar MS-68 — $10,000+

- 1964 Washington quarter MS-67 — $200–500

- Deep cameo proof issues with flawless surfaces

Survival rates drop sharply at the top grades. That scarcity drives premiums, not the date itself.

High-Value 1960s Coins at a Glance

| Coin | High Value Driver | Auction Peak |

| 1964 Kennedy Half MS-68 | Final 90% silver gem | $10,000+ |

| 1960-D D/D Cent | Key overdate variety | $5,000 MS |

| 1969-S DDO Cent | Major doubled die | $35,000 |

| 1964 Quarter MS-67 | Final silver type | $200–500 |

| 1960 Proof Small Date | Scarce logotype | $300 PR-67 |

Proofs and Mint Errors

Proof coins from 1964 and earlier attract steady interest as pre-clad issues. Errors add another layer.

Notable premium drivers:

- Off-center strikes

- Wrong-planchet errors

- Broadstrikes with full detail

Certified examples regularly cross $1,000, though altered coins and counterfeits remain common.

The pattern is consistent. The 1960s do not reward casual accumulation. They reward verified rarity, sharp grading, and careful documentation.

How to Spot Value Fast and Set Realistic Expectations

Coins from the 1960s reward efficiency. The difference between a common piece and a valuable one often shows up in seconds if you know what to check first. Collectors who work methodically avoid wasted time and focus on coins with real upside.

A Fast Screening Process

Start with metal. It filters most coins immediately.

- 1964 and earlier dimes, quarters, halves → 90% silver

- 1965–1970 Kennedy halves → 40% silver

- Anything else → base metal, value depends on variety or condition

Next, look at the condition. Worn silver trades on melt. Sharp, original surfaces signal potential premiums.

For cents, the process changes:

- Check 1960 cents for Small Date vs. Large Date

- Inspect Denver coins for repunched mint marks

- Scan 1964 and 1969 cents for known doubled dies

A 10× loupe and steady light catch most diagnostics.

Using Tools to Save Time

Sorting large groups manually slows progress. Digital tools help isolate candidates quickly. The Coin ID Scanner app offers freemium photo identification on Android and iOS. Upload or photograph a coin and receive a detailed coin card showing year of minting, country, coin type, composition, diameter, weight, edge type, and an indicative price range from a database exceeding 187,000 coins.

This speeds up the process of separating routine 1960s change from silver issues and documented varieties, especially when working through jars, estate lots, or dealer trays.

Once promising pieces are identified, the app’s collection management tools help keep records organized. Premium features such as smart filters and the AI Helper assist with comparisons, allowing collectors to track silver totals and variety targets in one place.

Realistic Market Expectations

Most circulated coins from the 1960s remain modest in value.

Typical outcomes:

- Common cents: face value to a few dollars

- Circulated silver: melt-driven pricing

- High-grade or error coins: certification required for liquidity

Serious prices require third-party grading. Slabs create trust, protect value, and open access to wider markets.

Coins from the 1960s can cost a lot, but only under precise conditions. Silver establishes the floor. Grade and variety create the ceiling. Collectors who apply a clear filter, verify authenticity, and document holdings carefully gain the advantage in a decade where small differences define big results.